Child Tax Credit South Africa

Can apply for credit. The Medical Schemes Fees Tax Credit provides for a standard monthly credit against your tax owing to Sars.

Basic Income

For the 2022 tax year ie.

Child tax credit south africa. B any other person who under the rules of a medical scheme is recognised as a dependent of a member. School fees can be claimed as a tax deduction in specific circumstances only and parents who try to claim fees as a donation face being penalised by the South African Revenue Service SARS. This entry was posted in Tax QA Bookmark the permalink.

Families can get half of their credit distributed in six. As the primary medical aid member you are entitled to a medical tax credit. This can be as a result of a physical sensory communication intellectual or mental impairment.

ZAR 2871 if the taxpayer is 75 years of age or over. Childrens Act 38 of 2005. The maximum credit for 2021 is 3600 for children under 6 and 3000 for children between 6 and 17.

Donald Trumps impeachment trial Stimulus plan with child tax credit. - 333 of the amount of contributions to a medical scheme as exceeds 3 times the Capital Allowances medical scheme fees tax credit. All additional dependants will receive a monthly tax credit of R209 for the 2018-2019 tax year.

Child Tax Credits Future Delta Variant Surges South Africa Violence. ZAR 8613 if the taxpayer is 65 years of age or over. Just In Climate Change Has Arrived In Germany Historic Floods Kill More Than 100 Link Copied Posted 1626438044307.

Treasury Secretary Janet Yellen talks taxes and getting Harriet Tubman on the 20 bill. News You Need To Start Your Day. Age of majority.

Thousands of Rands of Tax Rebates go unclaimed every year. Its a fixed monthly amount that increases according to the number of dependants. Many taxpayers are unaware that they may be eligible for additional and substantial tax rebates on their medical aid and medical expenses if they their spouse or one of their children have a mild to severe.

Taxpayers under 65 years. A the spouse or partner dependent children or other members of the members immediate family in respect of whom the member is liable for family care and support. The Democratic stimulus law in March turned it into a one-year cash benefit for most American families.

A dependent as defined in section 1 of the MS Act means. 20192020 medical tax credit rates. News You Need To Start Your Day.

The child tax credit provides up to 300 a month for each child under 17. 5 June 2015 at 825. Child Tax Credits Future Delta Variant Surges South Africa Violence.

- 25 of the aggregate of the amount of fees paid to a medical scheme as exceeds. The medical scheme fees tax credit MTC is a non-refundable rebate that applies to the taxpayers contributions to a registered medical aid scheme in South Africa. An emancipated minor is a child who has been given express or implied consent by a parent or guardian to participate in commercial contracts independently.

Experts on impeachment trial stimulus plan with child tax credit schools reopening vaccines for grocery workers vaccine rollout inequity AstraZeneca vaccine halted in South Africa NYC homeless shelter sexual misconduct Haiti Myanmar and Georgia m This week WMC SheSource features experts on. ZAR 15714 for all natural persons. The tax year commencing on 1 March 2021 and ending on 28 February 2022 the following rebates apply.

No unfortunately not we dont have such a credit. Additional refunds of between R5000 to R50000 are expected. Is there such a thing as childcare tax credit in South Africa.

The delta variant is surging where vaccination rates are low and South Africa has seen a. Posted 23 June 2015 under Tax QA. - 333 of qualifying medical expenses paid and borne by the individual.

How would I go about it. The limitation and the extent thereof will only be regarded as a disability if it has lasted or has a. A disability for tax purposes means a moderate to severe limitation of any persons ability to function or perform daily activities.

4 June 2015 at 1212. Republic of South Africa Act 108 of 1996. If you are paying your contributions via your employer ie as a deduction from your salary or wages your employer is obliged to use the credit system to adjust your monthly PAYE tax accordingly.

Taxpayer spouse or child.

Understanding How Medical Aid Tax Credits Work Moneyweb

What Is A Tax Credit How It S Calculated And Types Of Credits

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

Understanding Medical Scheme Fees Tax Credits

National Budget Speech 2013 How It Will Affect You Budgeting Infographic Speech

Https Www2 Deloitte Com Content Dam Deloitte Za Documents Tax Deloitte Africa Quick Tax Guide 2021 2022 Pdf

Child Tax Credit Coming By Mail For Some Who Got Bank Deposit In July

South Africa Individual Other Tax Credits And Incentives

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

What Medical Aid Expenses Are Tax Deductible Medical Aid Quotes

Medical Aid Tax Credits For 2020 And 2021 Medical Aid Quotes

Corporate Tax In South Africa A Guide For Expats Expatica

Medical Aid Tax Credits For 2020 And 2021 Medical Aid Quotes

Medical Aid Tax Credits For 2020 And 2021 Medical Aid Quotes

Adoption From South Africa South Africa Orphans South Africa Adoption

Allan Gray 2020 Budget Speech Update

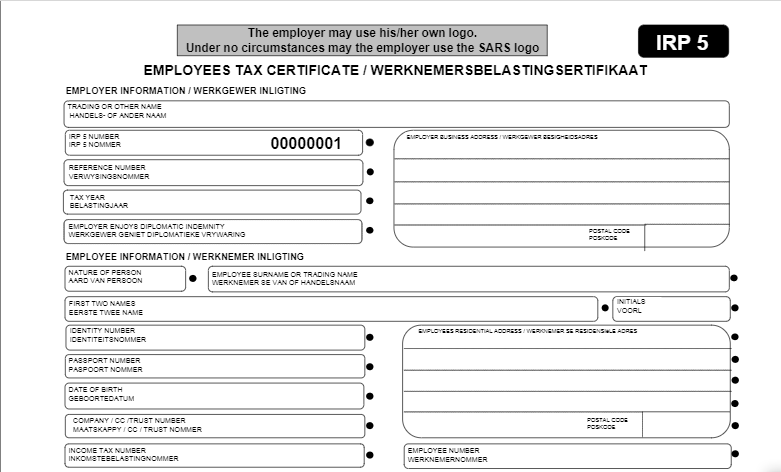

Irp5 Form Everything You Need To Know Including The Pdf Download Link

Corporate Tax In South Africa A Guide For Expats Expatica